Blackstone’s flagship property fund got a boost that bosses hope will deter investors from asking for their money back. There is a catch: It had to agree to sweeter terms than normal.

On Tuesday, the New York private equity firm said that the University of California will buy shares worth $4 billion in BREIT. The nontraded real-estate fund has received more applications from clients asking to take their cash out than it can contractually pay. In December, investors put in redemption requests equivalent to 5.44% of the fund’s total net asset value, above both BREIT’s 2% monthly and 5% quarterly limits.

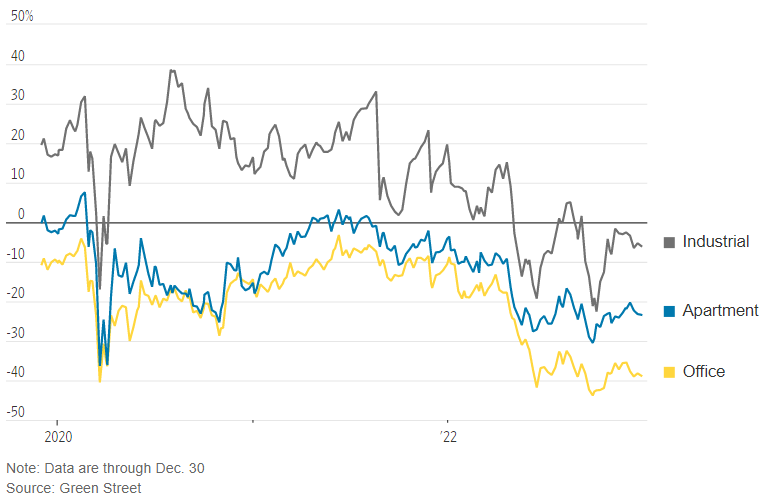

The university has bought in at BREIT’s current net asset value, or NAV, which rose last year and values the underlying property at an exit capitalization or cap rate—a measure of yield—of 5.6%. The price Blackstone is putting on the fund’s real estate, roughly half of which is housing, has come under scrutiny. As interest rates rise, a gap is opening up between the valuations used by private landlords and the sharper property-price falls implied by the shares of listed real-estate investment trusts.

That means the University of California could have gotten a slightly better deal in the public market, where residential property stocks have a cap rate of around 5.9%, according to research company Green Street estimates. However, BREIT also owns industrial real estate, such as e-commerce warehouses, which are valued more highly.

Investors expect lower property prices

U.S real-estate stocks, discount to net asset value

A more reassuring sign would have been for the University of California to buy in at NAV on precisely the same terms as other shareholders. Instead, the university has been guaranteed an annual return of at least 11.25% for keeping its money locked up for six years. If BREIT doesn’t hit this hurdle, Blackstone will make up the difference to a specific limit. The firm has provided BREIT shares worth $1 billion as collateral.

Blackstone is Predicting Good Revenue on Investments

Factoring in this collateral together with its fees, Blackstone needs to make a minimum annual return of 8.7% between now and 2028 to make money on the deal. This would be a slowdown for the fund, which has delivered 12.7% annually since it was set up six years ago. Its best bet for keeping this record on track is further rent growth in warehouses and residential housing. In its absence, the fund might be able to take on more debt to boost returns, but this comes with its own risks.

BREIT wasn’t under severe pressure for money to meet redemptions as it had several billion dollars worth of cash to hand. But the backing of a big institutional investor might calm clients’ nerves and stop the situation from getting out of hand.

It also means the Blackstone fund has more money to buy new properties. Management says the next few years will be ripe for snapping up real estate. If that is so, BREIT will have to explain how it thinks other property owners will be forced to offer bargains without impacting its valuations. It could be that some landlords need to sell real estate at less-than-ideal prices as refinancing becomes more expensive, but if this becomes a broad trend, it will hit the whole market.

However, the property market fares in 2023, and a fresh chunk of cash means Blackstone won’t be under pressure to sell. Accepting discounts on its real estate would make it tough to justify BREIT’s current valuation. While the University of California hasn’t given as fulsome an endorsement as the fund’s bosses might like, it is still a good result for Blackstone.