High mortgage rates and tight inventory pressured deals at the end of 2022, but the market is still stronger than it was three years ago.

Manhattan’s homebuying market weakened at the end of last year but didn’t foreshadow a deep freeze heading into 2023.

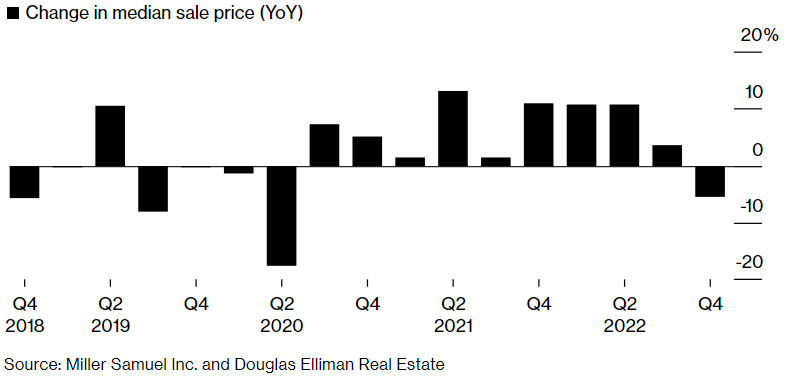

According to appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate, co-ops and condos traded for a median of $1.1 million in the fourth quarter, a 5.5% drop from the same period in 2021. It was the first year-over-year price decrease since sales stalled at the beginning of the pandemic in the second quarter of 2020.

Manhattan Home Prices Slip

The decline in the fourth quarter was the first since the pandemic began

The quarter doesn’t appear to be the start of a steep tumble.

“You’re going to see a modest decline in pricing over the year, but not a correction,” said Jonathan Miller, president of Miller Samuel.

According to Miller, a tight inventory is “underpinning” property values and keeping them from falling more dramatically. As is the case across the US, Manhattan sellers are reluctant to settle for discounted prices or give up the low mortgage rates they secured before the Federal Reserve began raising interest rates in early 2022.

There were 6,523 homes on the market at the end of the fourth quarter. While that’s up 5.1% from a year earlier, it’s down 16% from the previous three months and still a low level for Manhattan.

With the average rate on a 30-year, fixed mortgage topping out at 7.08% during the fourth quarter, the share of Manhattan buyers paying all cash was just over 55%. That was the highest share measured by Miller Samuel and Douglas Elliman since they started tracking forms of payment in 2014.

The pressures contributed to a slowdown in deals. Closed purchases totaled 2,546, down roughly 30% from the third quarter and a year earlier.

Even as short-term comparisons might suggest that Manhattan is struggling, the fourth-quarter data show a stronger market than just before the pandemic. While prices have retreated from their highs, they’re still 10% above the $999,000 median at the end of 2019, and closings totaled nearly 6% more than three years ago.

“The overall narrative is more negative than it is,” Miller said.