Commercial Property Boom Nearly $1.5 trillion in commercial mortgages are coming due over the next three years, according to data provider Trepp.The loan structure leaves many commercial landlords on the hook for the loans vulnerable to default.

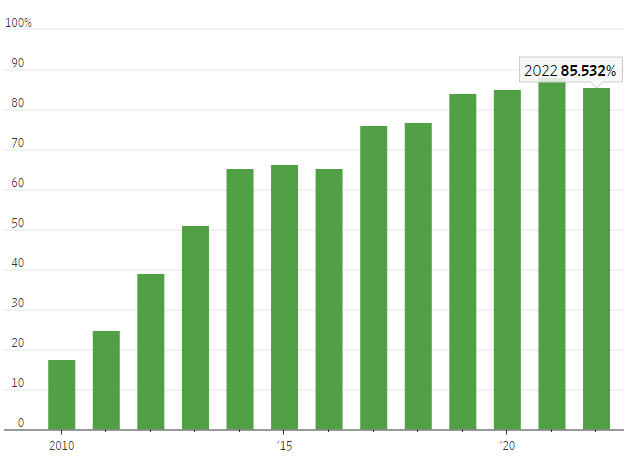

Commercial mortgages, in contrast to most home loans that borrowers pay down annually, feature interest-only payment structures. Borrowers make only interest payments during the life of the loan, with the entire principal due at the end. This trend has been fueled by the rise in interest-only loans as a share of new commercial mortgage-backed securities issuance, which increased to 88% in 2021, up from 51% in 2013, according to Trepp.

The surge in interest-only loans has created a precarious situation for commercial property owners. Traditionally, owners paid off this debt by securing a new loan or selling the building. However, the increasing borrowing costs and the growing reluctance of lenders to refinance these loans are now raising concerns that many borrowers may not repay them. Furthermore, banks, under pressure from regulators and shareholders to strengthen their balance sheets, have significantly reduced issuing new loans for office buildings. Falling demand due to remote work and e-commerce has also impacted office and mall owners, resulting in declining building values.

The combination of these factors is weighing heavily on building values, reducing the borrowing capacity of property owners, and increasing the risk of defaults. According to Gregg Williams, principal receiver at Trident Pacific, a receivership firm for defaulted commercial mortgages, this situation is the result of the rapid increase in interest rates and the changing dynamics of how people work.

Get a WSJ Renewal Subscription Clicking Here

Fitch Ratings recently estimated that 35% of pooled securitized commercial mortgages coming due between April and December 2023 won’t be able to refinance based on current interest rates and the properties’ incomes and values. Office owners, in particular, are facing a dire situation. The rise in defaults has the potential to create a ripple effect in the commercial real estate market, leading to distressed sales and declining property values. Additionally, regional and community banks heavily exposed to the sector may face write-downs on the value of commercial mortgages and the need to allocate more cash to cover potential losses.

While mortgage defaults are still relatively rare, they are rising rapidly. According to data company Trepp, the share of securitized office loans that are delinquent reached 4.02% in May, up from 2.77% in April and the highest level since 2018.

Interest-only loans became more prevalent in the middle of the past decade, offering lower annual payments and allowing property owners to rely less on their own cash. This boosted profits during good times. However, the assumption that property valuations would continue to rise and owners could simply pay off the loan with a new one has proven problematic. Many landlords are now finding it increasingly challenging to secure new loans of sufficient size to repay their existing debts.

One example of this is Centre Square, a 1.8-million-square-foot office complex in Philadelphia. Owner Nightingale Properties took out a $368 million balloon mortgage against the property in late 2019. When the mortgage matured in December 2022, Nightingale was unable to pay it off, resulting in potential foreclosure proceedings.

Check out our line of valuation services

Defaults don’t always result in lenders taking possession of the property. Property owners can sometimes avoid foreclosure by using their own funds or renegotiating the terms of their mortgages. However, lenders are currently exhibiting less patience compared to previous periods, as observed by debt brokers and attorneys. Mark Edelstein, chair of law firm Morrison Foerster’s global real-estate group, states that more lenders are taking over office buildings now than at any point since the early 1990s.

Following the 2008 financial crisis, banks were more inclined to extend troubled loans, anticipating a swift recovery and increased building values. However, the current outlook is different, with fewer lenders betting on a quick recovery, particularly in the office sector. The prevalence of remote work is expected to continue, leading to potential challenges for office towers in the coming years.