Sunbelt Construction have historic numbers of new rental apartments opening over the next 18 months are poised to decrease profits for the largest publicly traded landlords, who are already contending with slower or declining rent growth.

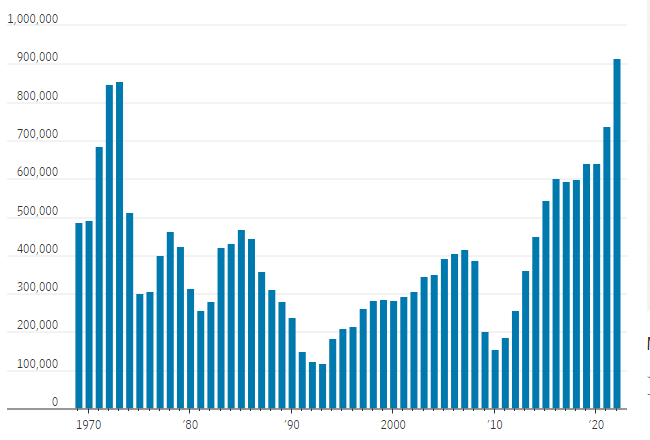

Nationally, more than 950,000 multifamily units are under construction, according to the U.S. Census Bureau. That equals three times the number for apartment construction from two decades ago.

The Sunbelt Construction boom is especially evident in Sunbelt cities, which are the most exposed to the recent ramp-up in new supply, according to a May report from real estate analytics firm Green Street.

For example, in Atlanta, rents are already flattening out. Sunbelt apartment owners now face the wave of new Sunbelt Construction following last year’s record-breaking building permits. Green Street predicts Atlanta occupancy rates will also decline.

Both firms beat consensus revenue expectations in the first quarter. But many investors are looking toward the year ahead, when new leases get signed at much lower rent increases and competition from new Sunbelt Construction becomes more of a factor.

During earnings calls in April, companies acknowledged pressure from new Sunbelt Construction units but expected short-lived negative effects. They anticipate a cooling off in future apartment development permitting in the Sunbelt region due to higher interest rates, making financing costly for builders. Both companies mentioned that the impact of the crush of new Sunbelt Construction units would be temporary.

Shares in Camden and Mid-America initially rose after late April earnings reports, but they are down since then. Both stocks have fallen about 3% since the start of the year. FTSE Nareit Equity Apartments index up 5% YTD, tracking publicly traded multifamily owners. That compares with a 12% gain for the S&P 500.

Multifamily units under construction

The Sunbelt Construction boom: Pent-up demand for housing exploded in the months after the introduction of Covid-19 vaccines in late 2020, and a surge in the number of people searching for apartments lifted rents 25% over two years.

That rapid growth pace has disappeared. May’s average market-rate apartment rent rose 2.6% to $1,716 compared to the previous year, per Yardi Matrix. That compares with the 15% annual increase seen in the first quarter of 2022, Yardi said.

Multifamily-building values fell 12% below their year-earlier levels this April, according to data provider MSCI Real Assets.

The recent softness shows that many tenants have a limit for how much they can pay in rent, while others might be spending less for fear of a slowing economy and the prospect of more job losses.

Rents decline in booming Sunbelt cities like Phoenix and Las Vegas, per Apartment List. Analysts predict slower job growth and lower rents.

UBS and Green Street report that Sunbelt Construction landlords anticipate profitable growth from leases signed during last year’s rent surge.

Sunbelt Construction landlords benefit from an unaffordable for-sale housing market, providing them with advantageous conditions.